Navigating the New Revenue Recognition Guidance

Navigating the new revenue recognition guidance with Cook CPA Group. Our Roseville and Sacramento CPAs explain the new revenue recognition standard, ASC 606, by the Financial Accounting Standards Board (FASB).

Feeling overwhelmed by the new revenue recognition guidance? You’re not alone! The new revenue recognition pronouncement, known as ASC 606, was issued by the Financial Accounting Standards Board (FASB) to help clarify how, when and why of revenue. The ultimate goal of the guidance is to align the price and timing of revenue with the transfer of goods and services to the customer. Revenues are recorded as they are earned, whether that is upfront, over time, or as milestones are reached.

ASC 606 was effective for year ends beginning after December 15, 2018 for non-public organizations. Although private companies are not required to use GAAP standards, many do as a general practice. There are times you might find yourself in need of GAAP compliant financial statements, for example, if you plan to complete a review or audit, or if your bank requires GAAP financial statements as part of lending requirements. Our Sacramento and Roseville tax accountants explain what you need to know about the new revenue recognition standards, also called ASC 606.

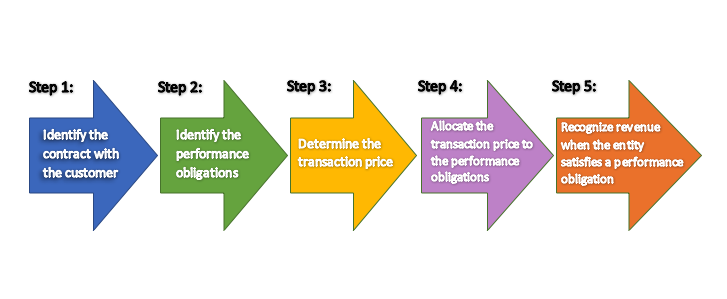

The Five-Step Revenue Recognition Process

Step 1: Identify the Contract

This step is simple enough. Determine if you have a contract with a customer. This may vary in form, but the basic idea is that everyone has approved the arrangement, is committed to performing their part of the deal and payment is reasonably assured. Best practice dictates the contract be in written form.

Step 2: Identify Performance Obligations

Review the contract to determine what performance obligations exist. Do you have more than one deliverable due to the client? Or perhaps you have an on-going monthly service arrangement, and you receive an annual payment up-front? What do you need to do to earn revenue? Some contracts will have multiple elements with different types of performance obligations. Review your contracts carefully to determine if any parts should be broken out or treated differently (i.e., initial revenue received, followed by an on-going monthly revenue stream could represent two different performance obligations).

Step 3: Determine Transaction Price

Review the contract to determine the transaction price. This price is the revenue that a company expects to realize, not necessarily the amount billed. In many cases, this is a simple step where the transaction price has been spelled out in the body of the contract. If other variables exist that affect the transaction price, such as discounts, rebates, incentives or performance bonuses, these will need to be factored in accordingly and will decrease the transaction price. If refunds are probable, you will also need to estimate the expected refund total and establish a refund liability account to record that amount.

Step 4: Allocate Transaction Value

If you have determined that more than one performance obligation exists, the transaction price will be split between each obligation. If you have stand-alone pricing that can be used to value a portion of the contract, that should be used to determine the transaction value of the other obligations. A pro-rata approach can also be used to value the obligations.

Step 5: Recognize Revenue

The hard part is done – you’ve figured out what the performance obligations are and how to allocate them. Once you have satisfied an obligation, that portion of revenue should be recognized. It’s important to document how you completed steps 1-5 so everyone is aware of how the revenue is being recorded.

Disclosure Requirements

Just when you thought you were done; you find yourself at year-end faced with the daunting task of disclosures. The new guidance uses revenue disclosures to summarize information in a way that will help users better understand the nature, amount, timing and uncertainty of revenue and cash flows of revenue streams from contracts with customers. The disclosures could be the most challenging aspect of this new revenue recognition model for your company.

These disclosures should include information about revenue type, product line, region, or other categories of importance to the organization. Disclosures should be based on what is relevant and significant to the company – for example, if substantially all revenue streams are earned at a point in time, there is no need to present information to reflect revenue streams based on the timing of revenue. Both qualitative and quantitative information regarding revenue and significant judgments should be presented. Most companies choose to present the quantitative disclosures in a tabular format, with the qualitative information in a narrative format. The requirements also vary between public and private entities, as more disclosures are required for public companies.

Typical disclosures include:

- Type of good or service (e.g., product or service lines)

- Timing of goods or services (e.g., earned at a point in time or over time)

- Geography, market or region

Disclosures should also present information about revenues recognized and received during the period. For deferred revenue, the entity will present a summary with the beginning deferred revenue balance, total revenue recognized from contracts during the period and ending deferred revenue balance. This should provide users with a clear picture of how quickly deferred revenue is being recognized and highlight any stale deferred revenue with unmet performance obligations.

Entities are also required to provide a description of their performance obligations with customers, including when they are typically satisfied, significant payment terms, the nature of goods or services promised, and obligations for returns, refunds or warranties. Information is also required about obligations that are partially satisfied or unsatisfied as well as the timing of when these obligations are expected to be satisfied.

Call Our Roseville and Sacramento Tax Accountants and CPAs Today

Still struggling to figure things out? Contact the Sacramento and Roseville business accountants for a free consultation about how our licensed CPAs can help. Call today at (916) 432-2218.