This is the final series with Ed Cotney as he concludes with an in-depth discussion of the IRA rules to consider other approaches to address required minimum distributions.

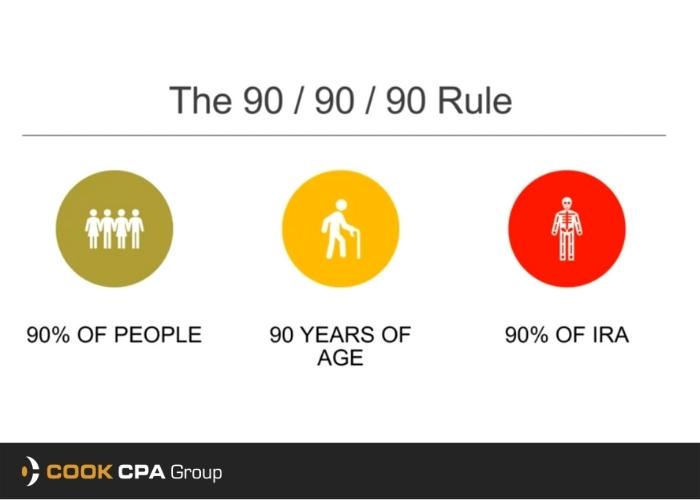

If you have an IRA or 401k and live to be age 90, and if all you do is take the required minimum distributions out once you turn 72, chances are you’re still going to have 90% of your IRA intact. So if you have a million-dollar IRA today and you’re 72 years old, chances are when you die, about $900,000 will still be in your IRA. Hence the 90 90 90 rule.

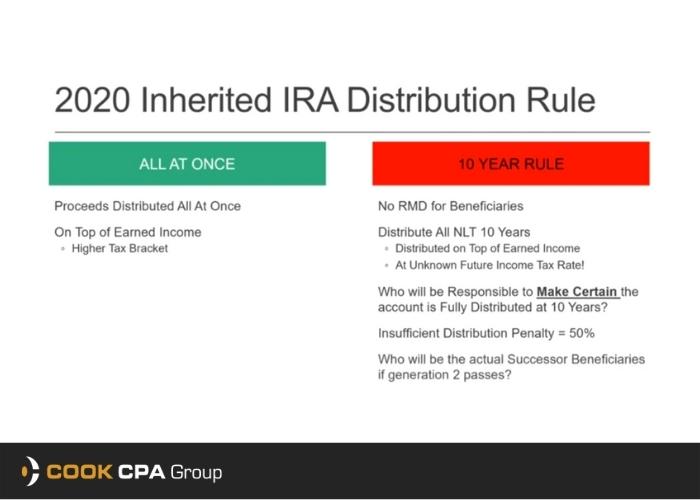

2020 Inherited IRA Distribution Rules and Risks of the 10-year rule

Giving It All At Once

Proceeds will be distributed all at once when you die. This will go on top of your children’s earned income resulting in a higher tax bracket.

10 Year Rule

The kids can let the money stay in the IRA for up to 10 years, and they just have to fully take out the inherited IRA after you die within ten years. There’s some risk exposure with this. The Kids have the right to take out their portion at any given time within the ten years after you die, and they will need to file a 1099r form.

If we do this ten-year rule, while the money is in the 10-year stretch rule; you need to ensure your kids don’t get enough bankruptcy or judgment. If one child does, they could lose the inherited IRA and could even pay a tax bill. You can check the Clark V. Ramaker Case as an example.

A Story Of How Converting IRA To CRUT Helps A Widowed Spouse

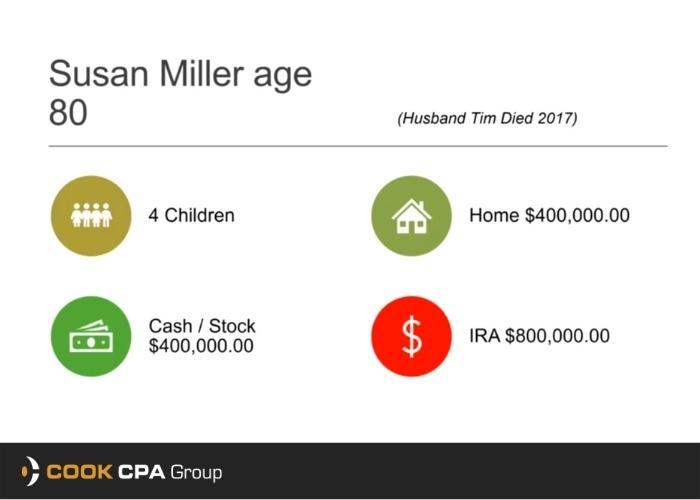

Tim and Susan want to transfer their wealth when they’re dying, their children free from tax, safe from lawsuits, and safe from creditors and predators. Tim passed away, and Susan’s age now is 80.

They have four kids, Susan has a house worth four hundred thousand dollars, and they have cash of $400,000, and Susan and Tim’s combined IRAs are $800,000.

The 1st kid, Mike, is a successful doctor and has a wonderful job. The 2nd daughter, Mary, didn’t marry very well. In fact, after Tim dies, his husband says, “I can’t wait for your mom to croak. This way, we can go buy a new truck and a bass boat”.

The 3rd son, Ed, is in a rocky third marriage, but he’s good with money. He’s good-looking too. The last son, Dan, is not good with money, is divorced, and looking for work.

Susan’s concerned that Dan will just waste his inheritance money and have to borrow from his siblings.

Taxes Issues Upon Death Of Susan

- House – No tax, because of Step up in basis

- Cash – No tax, because of Step up in basis

- IRA/401K – Will have an Ordinary Income Tax

How The Charitable Trust Come In-Play

Calculating the total value of the asset, we got $1,600,000. We know that the non-ira assets, the house, and the cash will go to the children with zero tax, and the estate plan says that when Tim and Susan die, the $800,000 IRA goes in four equal distributions to the kids.

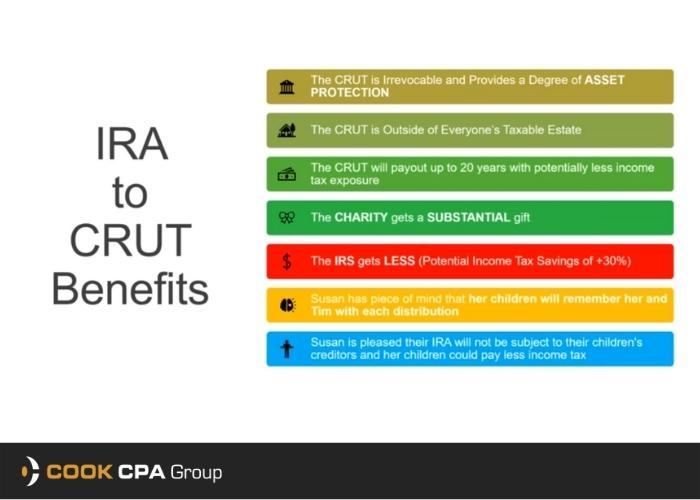

When Susan dies, the $800,000 will go to a charitable trust. This trust is designed to be a 20-year income payout to the four children using a very conservative number of 5.3%. We’re going to distribute $42,000 divided by four, so each child will get about $10,000 to $11,000 for the next 20 years. In total, we’re going to distribute out $896,000 of taxable income to the kids.

Now, here’s what’s cool about this strategy. This $800,000 has a high degree of asset protection from judgment, creditors, and predators. So, for example, in year 4, after Susan dies, Brother Dan gets into a divorce. He is receiving an income stream from the charitable trust but can’t take any money from it—that way, protecting himself.

And for Mike, the doctor, this is a smart deal too. It’s not a question of will Mike be in a lawsuit as a doctor. It’s a question of how many lawsuits he will be in during the rest of his life. So the last thing he needs to get is something that doesn’t have some form of creditor protection.

The last benefit from this is at the end of 20 years, after this charitable trust has paid out nearly $900,000 to the kids, almost $900,000 will go to her designated church.

Takeaway

This is not a multi-million dollar Warren Buffett strategy. This strategy works for anybody with at least $500,000 in qualified money, like a traditional IRA or 401k. This is a strategy where using a charitable trust provides a beautiful income stream to the kids and a beautiful gift to your designated charity.

There’s nothing severely advanced or complex here. You may have to spend a little bit of money for the lawyers to draft this, but this blows the doors of leaving an inherited IRA to a child so that they can take the money out over ten years at some point. By using charitable trust, we are making money off the IRS.