Hiring a CFO is an essential step in ensuring your company’s financial health. However, many CFOs get so bogged down with competing priorities that they struggle with the time management skills necessary to complete the job effectively.

While we are champions of the outsourced CFO model (check out our outsourced CFO service here), we also recognize the CFO on your team is always looking for effective tricks that can make their job easier. Plus, having a successful CFO means your business can run on autopilot.

Share the following six effective tricks with your CFO to improve their effectiveness and streamline your business processes.

Optimize Cross-Team Documents

CFOs have a lot on their plate. Working from a cross-functional perspective, CFOs often have a hand in many of your business operations. While this is an excellent perspective when defining your business strategy, dealing with multiple sources of information can slow down even the savviest financial pros.

Implementing a business-wide policy of data version control is a time-saving trick your business CFO should understand and leverage. Instead of wasting time sorting through different versions of data, encourage your teams to work from one source of truth – a single financial spreadsheet. Creating a model document you can use to collect data across your organization saves your CFO time and costly mistakes.

Leverage Business-Grade Financial Software

Investing in your team is one of the most important things you can do to maintain a healthy business. According to Continuum Cloud’s 2019 State of Workforce Management Report, 73% of CFOs report a significant return on investment in implementing digital tools.

Leveraging business-grade software enhances the efficiency and efficacy of your business while making it easy for your team to do their job. Financial software helps CFOs save time on routine tasks that are traditionally unconsolidated. Aggregating data from multiple sources and automating several financial functions helps your financial team work more effectively with other business operation teams.

If you want your CFO to give you more effective strategic advice, take advantage of the wide-ranging software options available.

Automate Financial Processes

In a similar vein to leveraging business-grade financial software, implementing automation in your business process can help your CFO save time. Keeping up with growing business demands is a primary struggle for most CFOs.

Automating data collection and reporting functions can go a long way in helping alleviate the overwhelm. You can help your CFO automate by offering to implement strict internal controls and cross-functional dashboards. Many financial software programs integrate seamlessly with your existing financial processes and offer these automation features.

Support your CFO and financial team by investing in automation software that fits their unique needs.

Focus On Strategic Reporting

An important function of any CFO role is reporting. But financial reporting can quickly become a time-wasting activity. Taking time to collect, analyze, and create a report on financial information provides valuable insight, but the key is to spend that time on strategic reporting.

If your company invests in business-grade financial automation software, much of the weekly or monthly reporting functions your CFO typically reports on can be automatically created. Distributing these reports through mid-level staff allows your time-strapped CFO the opportunity to think strategically.

Encouraging your CFO to move away from day-to-day reporting and take a higher-level approach to the business strategy can be the catalyst for the growth your business needs. While your CFO is well-versed in daily operations, it may be necessary to outline operational expectations beyond monthly models.

Give your CFO the tools and guidelines to spend more of their time on strategic reporting for the foreseeable future so they can hand the reigns of daily operation to their executive team.

Create Internal Risk Management Protocols

The responsibility for risk management often falls to the CFO in small to mid-sized companies. Collaborating with an in-house or outsourced legal team on risk management issues can be a time and energy drain.

A time-saving trick for your CFO is to implement a strategic company-wide risk assessment. With the help of a legal team, your CFO’s team can quickly develop a risk management process that protects your business in the event company standards are compromised.

While this takes upfront work, having risk protocols in place ensures a huge return on time in the future.

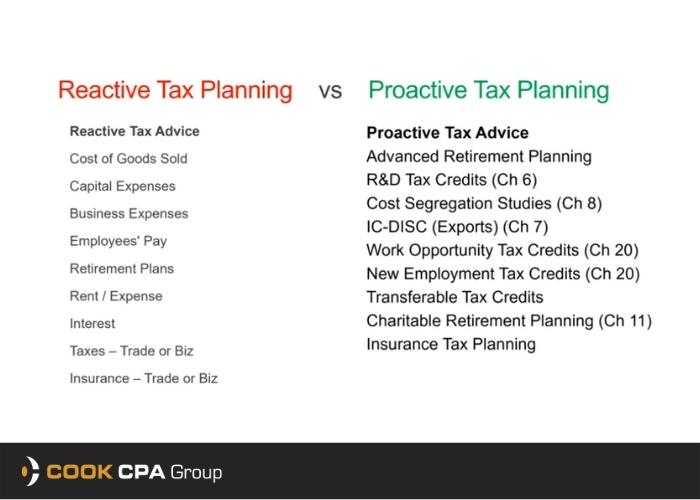

Build Proactive Strategies

It’s no secret that CFOs wear many hats. From financial analysis to risk management and goal setting, CFOs have plenty of work to keep them busy the whole day. However, getting trapped in endless work cycles without taking the time to anticipate problems can be a risk for your business.

An effective CFO can save time and energy by delegating daily operations to their staff. In turn, they can spend the freed-up time anticipating potential problems in the business and developing proactive strategies to mitigate them.

Your CFO is an integral part of the decision-making process of your business. You must encourage them to make space in their day to look out for solutions for any potential problems that may arise.

It may be wise to outsource your CFO functions if you believe your CFO is struggling to be as effective as they could be. At Cook CPA Group, we’ve worked with hundreds of business clients and seen how the best businesses have scaled their operations. Schedule a free consultation today to find out how we can help your CFO and your business achieve financial goals.

The blog “Common Things to Consider When Starting a Business” discussed initial considerations for potential business owners such as meeting with professionals and setting up insurance. Once you have taken some initial steps and your business is moving forward, you may want to revisit some of these. And this is an essential step if you want to learn how to get your business back on track.

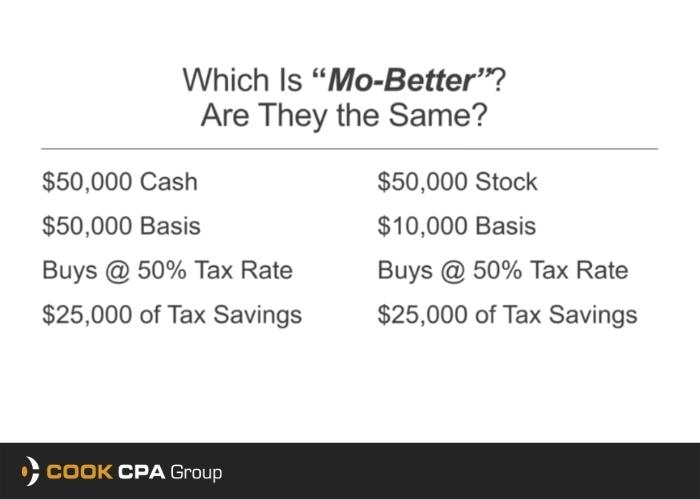

The blog “Common Things to Consider When Starting a Business” discussed initial considerations for potential business owners such as meeting with professionals and setting up insurance. Once you have taken some initial steps and your business is moving forward, you may want to revisit some of these. And this is an essential step if you want to learn how to get your business back on track.  If you worked with an attorney initially to set up your business name and form an entity, you may still need to work with your bookkeeper and CPA to make sure your business entity meets your needs and future goals. Reviewing your daily financial and monthly financial reports from your bookkeeper can give you important information about whether you are meeting your growth targets. This information can help your CPA determine if your business entity is the right one for tax purposes and future growth.

If you worked with an attorney initially to set up your business name and form an entity, you may still need to work with your bookkeeper and CPA to make sure your business entity meets your needs and future goals. Reviewing your daily financial and monthly financial reports from your bookkeeper can give you important information about whether you are meeting your growth targets. This information can help your CPA determine if your business entity is the right one for tax purposes and future growth.  Top line revenue growth means the increase in gross sales of a company over a certain time period, and the measure indicates the financial strength of a company. The name “top line” doesn’t indicate something that is superior; instead, the name comes from this figure being at the top of a company’s profit/loss statement. This measure applies to a specific reporting period, and the figure is calculated on core business operations (doesn’t include interest or gains from sale of assets).

Top line revenue growth means the increase in gross sales of a company over a certain time period, and the measure indicates the financial strength of a company. The name “top line” doesn’t indicate something that is superior; instead, the name comes from this figure being at the top of a company’s profit/loss statement. This measure applies to a specific reporting period, and the figure is calculated on core business operations (doesn’t include interest or gains from sale of assets).